As the prices of homes rise, you may find yourself in the same spot I was in 2012.

I would search online for low priced homes in good areas, only to show up to see 10 cars with investors peeking in the windows. All of them bid with cash offers, which my FHA loan could never compete with. Why should it? Cash is king and a quick closing date is appealing with a cash offer. But where does that leave the rest of us who need affordable housing for our families to live in?

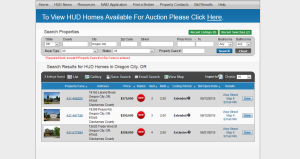

Buying a house via HUD could be a great option. You search for the homes on their website. The types of home range from almost brand new to major fixer upper. Across the board, the homes are usually much better priced. The HUD people open the house up for offers every week. On Sunday night they close the bidding down. Within 24 hours you will know if your bid has been accepted.

So what is a HUD Home?

“A HUD home is a 1-to-4 unit residential property acquired by HUD as a result of a foreclosure action on an FHA-insured mortgage. HUD becomes the property owner and offers it for sale to recover the loss on the foreclosure claim.”

The value in a HUD home is that usually for at least the first 10 days the house is offered to owner occupants or non-profits. No investors allowed! Owners agree to occupy the home for at least 2 years before selling or renting. Doing this is suppose to create more stability within the community. HUD evaluate the home prices regularly and will often drop the price significantly at a time if they continue to not get good enough net offers.

Once your offer is accepted, get ready for a serious amount of paperwork! For this reason I STRONGLY suggest you use an agent and loan officer who has processed HUD homes many times before. Ask them for examples. I would not settle for, “I’m sure I can handle it”. Agents must be registered to bid on the homes on HUD’s website. When it comes to buying homes from a government agency, they do not mess around. If your agent does not do the paper work accurately, you can get kicked out of the process. It is an involved process that usually takes longer to close the sale. Also you need to be prepared of many deadlines. If you go past the deadlines HUD has set, they will charge you a fee for each day you go over. So if you have a loan officer who is dawdling on your paperwork, that could end in a hefty bill you were not prepared to pay.

If I have not scared you away, one benefit is that HUD homes are suppose to live up to a certain standard or they usually will credit you an allowance for work to be done. Things like proper floor coverings, lead paint exposure, chipped paint, working bathrooms, and heating are all assessed. (Though you should always do your own due diligence) The other end of that is sometimes you have to agree to pay yourself for certain work to be done, and then prove it was done to purchase your house. In my case, we had to pay for our exterior of our home to be painted as well as a new furnace put in. Luckily, you can finance these items into your loan.

My overall experience with buying HUD home was that it was much more difficult of a process then my previous conventional purchase, but since I had a great agent helping us, it was manageable. Since I like to look into the details of sales, I was able to save us an incredible amount of money by pestering the loan officer to make sure the deal closed in HUD’s dictated time period. To sum it up: buying was hard, but I would do it all over again to get that kind of deal on a house.